Fraud Expert Checklist

Introduction

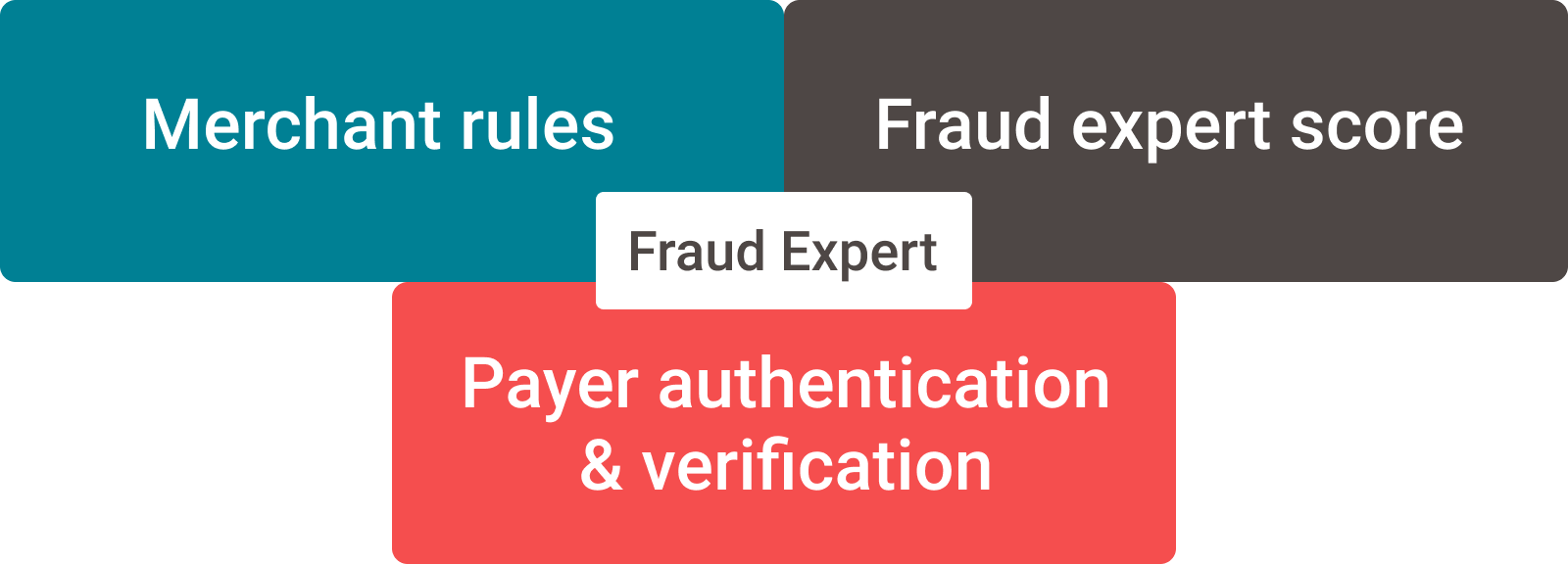

There is nothing worse than dealing with online fraud. That is why we take fraud very seriously at PAYONE E-Payment. Our Fraud Expert Checklist offers you more control and insights to effectively take your fraud protection strategy to the next level.

Fraud Expert Checklist is able to:

- Create rules on a checklist that has been adapted uniquely to your business and industry needs! These rules help to identify potentially risky transactions. Once these transactions have been identified, you decide what action to take.

- Take advantage of data intelligence to detect real-time fraud threats.

- Provide you a second expert opinion to make faster and more accurate decisions.

The best part about our automated solution is that it saves you precious time and allows you to process most of your transactions quickly while keeping your customer happy! If you would like to know more about our Fraud solutions, get in touch with us.

Contact us to set up the Fraud Module in your account.

Send Fraud parameters in transaction requests

Once we have configured the module in your account, you are now ready to send transaction requests evoking Fraud checks.

The actual Fraud check covers two steps:

- Add the properties in the fraudfields object that are relevant to either of the list(s) and/or rules to a CreatePayment/CreateHostedCheckout request. A typical request looks like this:

{ "cardPaymentMethodSpecificInput": { "card": { "cvv": "451", "cardNumber": "4012005616165343", "expiryDate": "1221", "cardholderName": "Wile E. Coyote" }, "isRecurring": false, "paymentProductId": 1, "transactionChannel": "ECOMMERCE", "threeDSecure": { "externalCardholderAuthenticationData": { "cavv" : "AAABBEg0VhI0VniQEjRWAAAAAAA=", "cavvalgorithm": "0", "directoryServerTransactionId" : "f25084f0-5b16-4c0a-ae5d-b24808a95e4b", "eci" : "7", "threeDSecureVersion" : "2.1.0" } } }, "fraudFields": { "customerIpAddress": "5.204.5.55" }, "order": { "amountOfMoney": { "currencyCode": "EUR", "amount": "100" }, "customer": { "billingAddress": { "countryCode": "NL" } }, "references": { "merchantOrderId": 123456, "merchantReference": "oGPc8xJURfpFitBa6ORrpkBuPoGpvD" } } } - Our platform compares the fraudfields properties with what we have configured in your account. If there is a match, our platform will block or accept the transaction

- A blocked transaction due to (suspected) Fraud reaches statusCode=2

- Object CardPaymentMethodSpecificOutput.FraudResults of a GetPayment requests contains detailed information about why a transaction has been accepted/blocked