Apple Pay

Intro

Apple Pay is Apple’s mobile payment product, which allows consumers an easy and secure way to pay for physical goods and services such as groceries, clothing, tickets and reservations in your iOS apps. By using Touch ID, users can quickly and securely provide their payment.

The consumer adds her/his credit or debit cards to their wallet on their iPhone and adds the payment and shipping information to the Apple Pay wallet. The payment details the consumer enters in the Apple Pay wallet are tokenized and then securely stored. If the consumer clicks the “Buy with Apple Pay” button in the app, the payment can immediately start, since the card with which the consumers wants to pay will be loaded from the Apple Pay wallet.

Our iOS SDK allows you to easily add Apple Pay to your mobile app. We will manage the decryption of the payment data for you. If you want to, you can also choose to decrypt the data yourself and send it over to us to process the payment.

Your customers can use cards from the following brands:

Apple Pay - Visa

Apple Pay - MasterCard

Apple Pay - American Express

Key benefits

- A frictionless consumer experience using Apple’s native Touch ID

- Easy integration for developers using our iOS SDK

- A secure way of paying as the card data of the consumer is tokenized and the Device PAN (DPAN) is used to process the payment.

- Increase your conversion for in-app payments

- Huge potential in terms of usage, due to the millions of users on iOS devices.

Payment experience

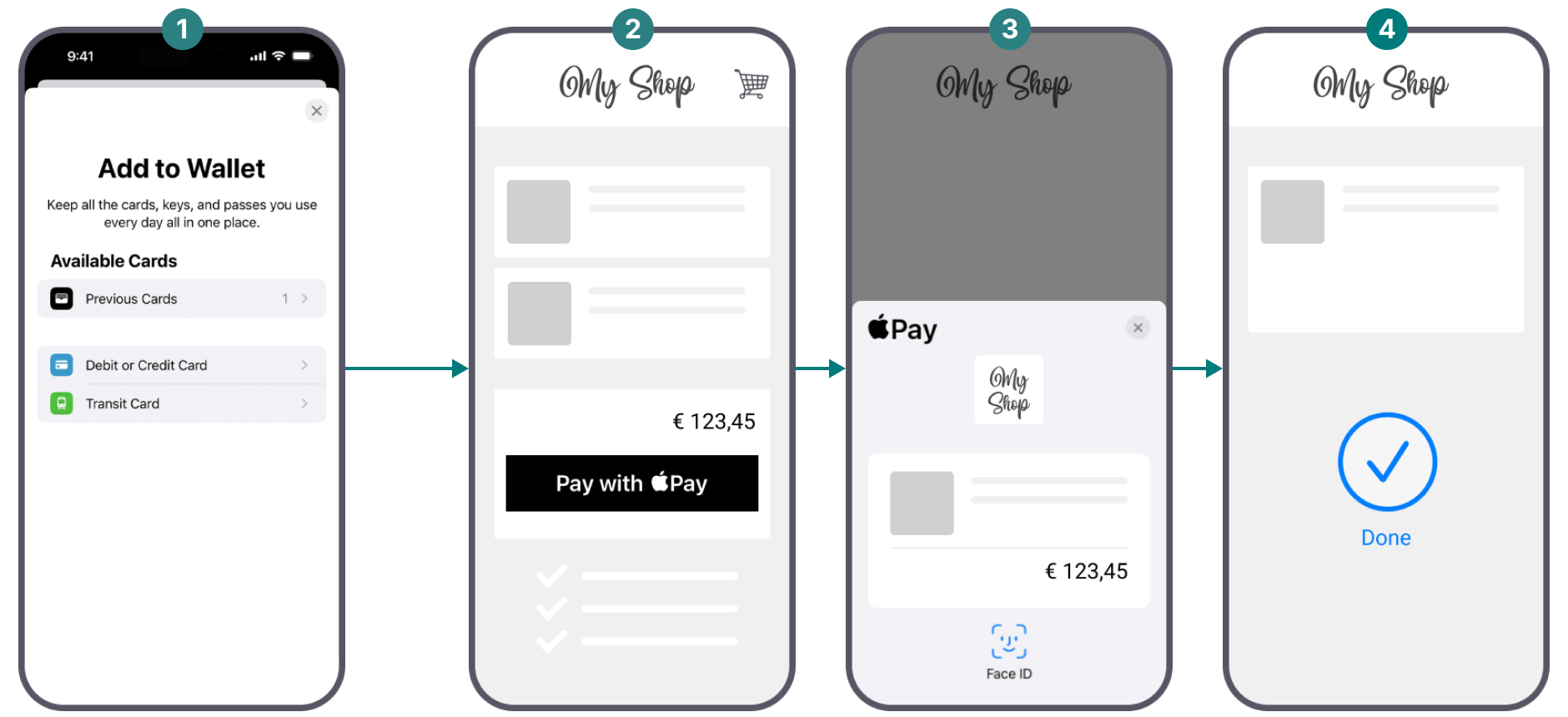

- In countries in which Apple Pay is supported, the option to add a card to the wallet on the device of the consumer will be enabled. The consumer can add her/his payment details as well as shipping and billing address in the app..

-

Within an app that supports Apple Pay, the button “Buy with Apple Pay” will appear when the consumer is ready to checkout.

-

The card details of the consumer are visible and can be changed upon wish of the consumer. Next to that the total amount is also displayed. The consumer will need to use Touch ID to validate the payment.

-

Once the payment is validated it will be sent via the typical purchase flow, so that we can process this payment.

Boarding

To accept payments for this payment method, make sure you

- Have an acquisition contract with one of the supported acquirers. We will clarify this with you during the onboarding process

- Accept Apple's terms and conditions as described in the dedicated chapter. This will allow you to register your Apple Merchant ID and to offer Apple Pay on our secure payment page

Countries & currencies

Supported countries

-

Australia

Australia

-

Belgium

Belgium

-

Brazil

Brazil

-

Bulgaria

Bulgaria

-

Canada

Canada

-

China

China

-

Croatia

Croatia

-

Cyprus

Cyprus

-

Czech Republic

Czech Republic

-

Denmark

Denmark

-

Estonia

Estonia

-

Finland

Finland

Supported currencies

- Albanian lek (ALL)

- Algerian dinar (DZD)

- Angolan kwanza (AOA)

- Argentine peso (ARS)

- Armenian dram (AMD)

- Aruban florin (AWG)

- Australian dollar (AUD)

- Azerbaijani manat (AZN)

- Bahamian dollar (BSD)

- Bahraini dinar (BHD)

- Bangladeshi taka (BDT)

- Barbados dollar (BBD)

Integration

To make this payment method appear on our Hosted Checkout Page as a selectable payment method, your customers need to:

- Be located in one of the supported countries.

- Own at least one of the supported cards in their Apple Pay wallet:

Apple Pay - Visa

Apple Pay - MasterCard

Apple Pay - American Express

. - Browse with Safari.

- Use one of the following devices:

iPhones with Face ID and/or Touch ID (except iPhones 5S).

iPad Pro, iPad Air, iPad, and iPad mini models with Touch ID or Face ID.

Apple Watch Series 1 and 2 and later, Apple Watch (1st generation).

Mac models with Touch ID, or Mac models introduced in 2012 or later with an Apple Pay-enabled iPhone or Apple Watch.

Make also sure to register your Merchant ID as described in the dedicated chapter.

Redirect your customers to the Apple Pay payment sheet via our Hosted Checkout Page. Find a high level overview in the "Process flows" chapter.

Hosted Checkout Page

Add the following properties to a standard CreateHostedCheckout request:

{

"order":{

"amountOfMoney":{

"currencyCode":"EUR",

"amount":1000

}

},

"hostedCheckoutSpecificInput":{

"locale":"en_GB",

"returnUrl":"https://yourReturnUrl.com"

},

"mobilePaymentMethodSpecificInput":{

"authorizationMode":"FINAL_AUTHORIZATION",

"paymentProductId":302

}

}| Properties | Remarks |

|---|---|

|

order.amountOfMoney |

amount: The gross amount you want to charge for this order. |

|

hostedCheckoutSpecificInput |

locale: The language version of our Hosted Checkout Page and the Apple Pay payment sheet. returnUrl: The URL we redirect your customers to after the payment has been finalised. |

|

mobilePaymentMethodSpecificInput |

authorizationMode: Set to either "FINAL_AUTHORIZATION"/"SALE" depending on whether you want to process payments in authorisation/direct sale mode. paymentProductId: The numeric identifier of the payment method on our platform. Find this id in the "Overview" chapter. It instructs our platform to send your customers directly to the Apple Pay payment sheet. If left out, our platform sends your customers to the Hosted Checkout Page instead, allowing them to choose this or any other payment method in your account. |

Find detailed information about this object and its properties in our CreateHostedCheckoutAPI.

Find detailed information about this object and its properties in our CreatePaymentAPI.

Find detailed information about this object and its properties in our CreatePaymentAPI.

Process flows

Make sure to register your Merchant ID as described here.

- Your customers finalise an order in your shop and select Apple Pay

- You send this CreateHostedCheckout request to our platform

- You redirect your customers via the redirectUrl to the Apple Pay payment sheet. Your customers confirm the payment

- Our platform receives encrypted payment data from Apple

- Our platform decrypts the payment data and sends it to your acquirer to process the payment

- We receive the transaction result

- You redirect your customers to your redirectUrl

- You request the transaction result from our platform via GetPayment or receive the result via webhooks

- If the transaction was successful, you can deliver the goods/services

Testing

Refer to our Test cases for test data and detailed instructions.

Make sure to use the right endpoint and switch back to the live URL as soon as you have finished your tests.

Additional information

Offering this payment method requires you to register your Merchant ID. To do so, follow these steps:

- Login to the Merchant Portal. Go to Business > Payment methods

- Read the Apple Pay terms and conditions by clicking on the respective link. Flag "I have read and accept terms & conditions" to approve them

- Click on "Activate Apple Pay". You are ready to offer Apple Pay to your customers via Hosted Checkout Page integration mode

Mind the following:

- If you reject the Apple Pay terms & conditions, the payment method will not be available on our Hosted Checkout Page

- Apple's terms and conditions can change. Keep yourself up to date by accessing them regularly